Pricing

For businesses of all sizes and needsBusiness Services

Discover our renowned services for CFDI compliance and enhance your business's tax control

CFDI Invoicing API

Multi organization

$299 MXN / Month + UsageCost per Stamp: $0.60 MXN

Tax includedREST API to automate CFDI invoicing for your business.Designed to automate every part of the CFDI invoicing process in Mexico. Includes stamping for all types of CFDI and complements, as well as withholdings. You can generate custom PDFs, send documents by email, and stay compliant with the current SAT standard (CFDI 4.0).

Full API accessFull access to all CFDI-related endpoints available in our API.

Compatibility with other productsThe API License is compatible with all our products. If you combine them, you can operate from the dashboard or via API, as needed.

Customer and product managementRegister and manage customers and products, consult key SAT catalogs (product/service codes, units of measure), validate customer tax info (name, RFC, tax regime, postal code), and check RFCs against the SAT blacklist.

Dashboard accessIncludes dashboard access to view, email, and cancel CFDIs issued via API. The license includes two users per organization: one admin and one additional user at no extra cost.

Branding, issuance control, and webhooksCustomize your documents with your brand, control issuance dates, store CFDIs for up to 5 years, and set up webhooks for asynchronous event notifications, such as cancellation responses.

Cost per issued CFDI (stamp): $0.60 MXN

Tax includedWeb Invoicing$199 MXN per Organization / Month + Usage

Cost per Stamp: $0.60 MXN

Tax includedCreate Income, Credit, and Payment CFDIs from an easy-to-use interface.Easily generate SAT-compliant CFDIs from your dashboard. This tool is ideal for professionals, businesses, and teams who need a simple and reliable way to create Income, Credit, and Payment invoices as part of their daily operations.

CFDI TypesIssue Income Invoices, Credit Notes (Egreso), Payment Complements (REP), and Withholding CFDIs (Retenciones), all SAT-compliant.

Compatibility with other productsCompatible with the API License, E-Receipts, and SAT Sync. All tools work from the same dashboard.

Customer and product managementRegister and manage customers and products manually from the dashboard.

Brand customizationAdd your logo and colors to personalize the PDF invoices you issue.

Control and delivery toolsDownload invoices, send by email, and cancel directly from the same interface.

Cost per issued CFDI (stamp): $0.60 MXN

Tax includedE-Receipts and Self-Invoicing Portal$599 MXN per Organization / Month + Usage

Cost per E-Receipt: $0.40 MXNCost per Stamp: $0.60 MXN

Tax includedSimplify your sales process with digital sales receipts. Your customers use your self-invoicing portal to get their CFDI.Generate non-fiscal sales receipts (E-Receipts) directly from your dashboard. They work like a ticket or sales note and are delivered to the customer as proof. If your customers need an invoice (CFDI), they can convert the E-Receipt into a CFDI from your self-invoicing portal.

Web E-Receipt creationIssue E-Receipts from the dashboard for any sale, service, or transaction, instantly and without needing to generate a CFDI upfront.

Compatibility with other productsIf combined with the API License or Web Invoicing, you can also issue and manage CFDIs via API or dashboard. Otherwise, CFDIs can only be generated from the self-invoicing portal.

Self-invoicing portalLet your customers convert their E-Receipts into official CFDIs using your branded self-invoicing portal. You can customize it with your logo and colors, and integrate it into your site, emails, or printed tickets.

CFDI issuance optionsGenerate individual CFDIs when the customer self-invoices, or create a global CFDI (required by SAT) that covers all non-invoiced E-Receipts for the period.

CustomizationPersonalize your customers' experience with your logo and colors. Applies to your self-invoicing portal, E-Receipts, and generated CFDIs.

Cost per issued E-Receipt: $0.40 MXN

Cost per self-invoiced CFDI (stamp): $0.60 MXN

Cost per global invoice (stamp): $0.60 MXN

Tax includedAutomatic SAT CFDI Downloads$999 MXN per Organization / Month + Usage

Cost per Synced CFDI: $0.20 MXN

Tax includedOur simplified solution lets you download all CFDIs issued and received for your organization, generated outside Facturapi, sorted by year and month.View all CFDIs available in the SAT for your organization, both issued and received, and get full visibility of external activity directly from your dashboard.

Issued and received CFDI syncAutomatically retrieve all CFDIs associated with your organization's RFC via SAT's Mass Download, both those issued by your organization and those you received.

Compatibility with other productsWhen combined with other products, synced CFDIs are shown alongside invoices, receipts, and other documents in the same dashboard.

Centralized accessView, download, and manage synced documents from your dashboard, with search and filter tools.

Custom integrationIf combined with the API License, you can access and manage all synced CFDIs via API.

Up-to-date recordsKeep your database aligned with SAT records for audits, internal reports, or tax compliance.

Cost per synced CFDI: $0.20 MXN

Tax includedPlatform Integrations

Add CFDI compliance to your payment platforms

Facturapi for Stripe$299 MXN per Organization / Month + Usage

Cost per Stamp: $0.60 MXN

Tax includedAutomate CFDI issuance from Stripe in minutes.Issue SAT-compliant CFDIs directly from your Stripe dashboard, using your connected Facturapi account. This integration links both platforms to automate invoicing without writing a single line of code.

Automatic CFDI generationIssue SAT-compliant CFDis every time a Stripe payment succeeds — no code required.

API access (optional)For advanced use cases, you can combine this app with the API License to access and manage your CFDis directly through your systems.

Quick setupInstall the app from the Stripe Marketplace and complete setup in minutes — no integration required.

Product compatibilityYou can also use this app in parallel with other Facturapi products, such as E-Receipts, Web Invoicing, or SAT CFDI Downloads — each managed from the Facturapi dashboard.

Access and historyAccess and review issued CFDis from your Facturapi account, even when invoices are triggered from Stripe.

Cost per issued CFDI (stamp): $0.60 MXN

Tax includedDocument customizationApply your logo, and color scheme to the invoice PDF.

Team Management

Extra Users

Invite team members to specific organizations within your account. Each extra user gets access to that organization's dashboard and its active tools — like e-invoicing, e-receipts, or CFDI sync. They won't have access to other organizations or to account-level settings.

$99 MXN / per User / MonthTax included

Start today, pay next month

No need to buy stamp packs in advance. Just issue your documents and we’ll charge you for usage on your next monthly invoice. No expiration dates or wasted credits.

High volume? Let's talk pricingIf you process a high volume of transactions or manage multiple organizations, we can offer custom pricing based on your actual usage. Let's build a solution that fits your needs.Talk to sales

Volume pricing optionsWork with our sales team to design a solution tailored to you.

Talk to salesVolume-based document pricing: Stamps

Stamps E-Receipts

E-Receipts Synced Documents

Synced Documents

Per-organization pricing: Web Invoicing

Web Invoicing E-Receipts & Self-Invoicing

E-Receipts & Self-Invoicing Download CFDI from SAT

Download CFDI from SAT

Try the API for freeExplore what's included in the API License with a 14-day free trial.

No credit card required: use test mode while you build your integration.

No credit card required: use test mode while you build your integration.

Start free trial

FAQ's

Do I need to pay for each issuing RFC?

With the CFDI Invoicing API you can register and operate multiple issuing RFCs through the API at no additional cost per RFC. The API is multi-RFC.

The products Web Invoicing, E-Receipts with Self-Invoicing, and Automatic SAT CFDI Downloads are contracted per organization (issuing RFC). These products work independently and allow you to operate manually from the dashboard; if you also have the API, those same organizations can be operated via API as well.

The products Web Invoicing, E-Receipts with Self-Invoicing, and Automatic SAT CFDI Downloads are contracted per organization (issuing RFC). These products work independently and allow you to operate manually from the dashboard; if you also have the API, those same organizations can be operated via API as well.

Do I need to be or have the help of a programmer to use Facturapi?

Web Invoicing, E-Receipts with Self-Invoicing, and Automatic SAT CFDI Downloads are easy to use from the dashboard and do not require technical knowledge.

The CFDI Invoicing API does require integration by a programmer, as it is designed for technical teams.

The CFDI Invoicing API does require integration by a programmer, as it is designed for technical teams.

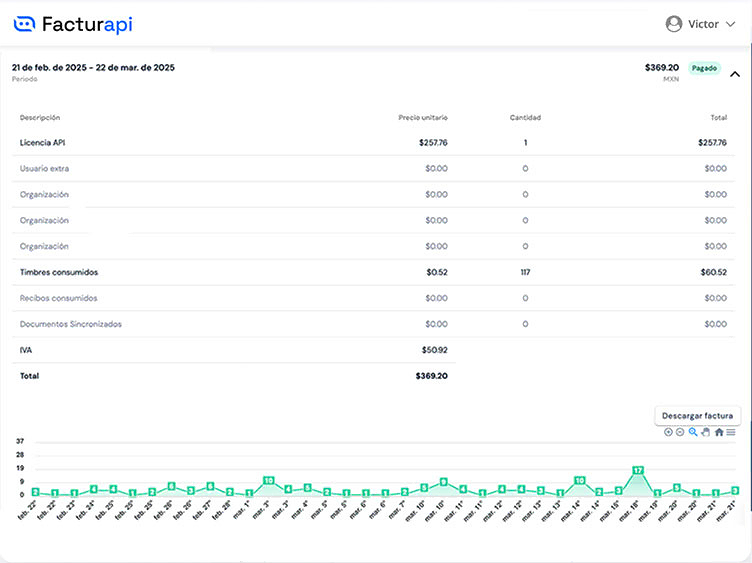

How are the subscription and consumables billed?

When you subscribe to any product (CFDI Invoicing API, Web Invoicing, E-Receipts with Self-Invoicing, or Automatic SAT CFDI Downloads), the subscription charge is made immediately.

Consumables —such as CFDI stamps, E-Receipts, and synchronized documents— are billed later: they are added to your next monthly invoice along with the subscription charge for the following period.

For example, if you subscribe to the API today, you will pay $299 MXN at that moment. The next month you will be charged again the $299 MXN subscription, plus the consumables you used during the previous month.

Consumables —such as CFDI stamps, E-Receipts, and synchronized documents— are billed later: they are added to your next monthly invoice along with the subscription charge for the following period.

For example, if you subscribe to the API today, you will pay $299 MXN at that moment. The next month you will be charged again the $299 MXN subscription, plus the consumables you used during the previous month.

Facturapi is a service that seeks to simplify our way of interacting with Mexican electronic invoicing, designing solutions oriented to eliminate complexity.

contacto@facturapi.ioProducts

Use Cases

© 2026 Facturapi. All rights reserved.