Thousands of national and international companies trust Facturapi for CFDI compliance in Mexico.

Improve the shopping experience on your platform by integrating E-Receipts

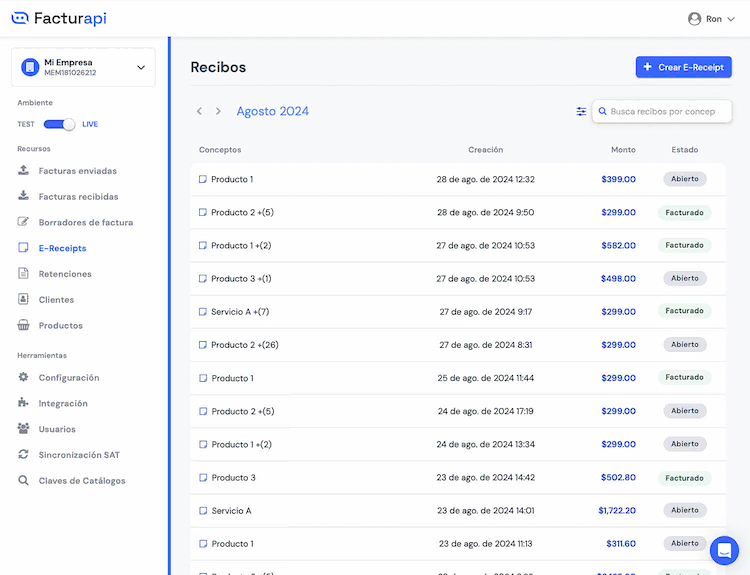

Streamline your sales processes

Automate the process of sending proofs of purchase with our API

Keep a precise control of your cash inflows

No need to calculate, with E-Receipts you will know exactly your total income.

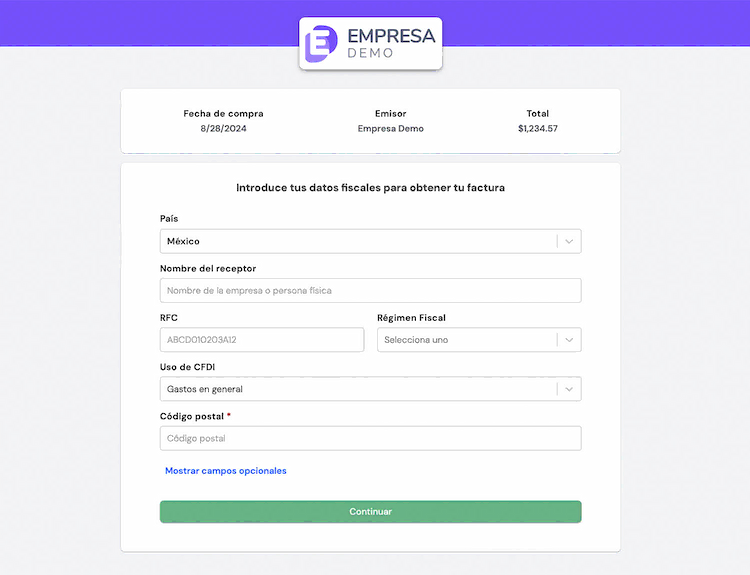

Self Invoicing Portal

Your customers will be able to create their own tax receipts (CFDI) through a platform with your customized branding and domain, accessible from any device. You will also be able to set deadlines for your clients to self-invoice E-Receipts, which adjust to your fiscal cycle.Customized self-invoicing platform

Set self-invoicing deadlines for your customers

Save time and resources in CFDI issuance and compliance

Benefits for your company

E-Receipts opens up new possibilitiesSelf-invoicing for your printed tickets

Control self-invoicing dates

E-Receipts always available

E-mail delivery service

Use your branding

Simplified global CFDI

Which companies can use receipts?

Schools

Small and large retailers

Hospitals

Gas stations

Pharmacies

And more

Automate with just a few lines of code

- NodeJS

- .NET

- PHP

- cURL

- Otro

1 import Facturapi from 'facturapi';

2 const facturapi = new Facturapi('TU_API_KEY');

3 // Crea un nuevo E-Receipt

4 const receipt = await facturapi.receipts.create({

5 items: [{

6 product: {

7 description: 'Ukelele',

8 product_key: '60131324',

9 price: 1375.99

10 }

11 }],

12 payment_form: facturapi.PaymentForm.DINERO_ELECTRONICO

13 });

What our customers are saying

FAQ's

Do I need to pay for each issuing RFC?

Do I need to be or have the help of a programmer to use Facturapi?

How are the subscription and consumables billed?

Test free of charge for 14 daysYou can start your integration and issue test invoices from day one.

When you are ready to start issuing tax valid invoices, sign up for a plan.

When you are ready to start issuing tax valid invoices, sign up for a plan.

Start free trial