Tax Updates

June, 20, 2025

Untangling CFDI: How to Simplify CFDI Compliance in Mexico (2025)

This article is part of Facturapi’s “Untangling CFDI” series of blog posts and articles aimed at making the Mexican CFDI and tax compliance process much more accessible to businesses of all scale, both domestic and international.

If you do business in Mexico, you’re required to issue CFDI (Comprobante Fiscal Digital por Internet) — the official electronic invoices mandated by SAT (Servicio de Administración Tributaria). As SAT regulations evolve, including the rollout of CFDI 4.0, staying compliant can feel overwhelming. From issuing invoices to managing cancellations and digital storage, the process involves multiple steps and technical requirements.

In this guide, we’ll present ways to simplify CFDI compliance in Mexico. This is an introductory guide with links to other resources that will provide deeper insights, such as CFDI API-based solutions and other applications that go beyond simple CFDI stamping in 2025 and beyond.

Why Simplifying CFDI Matters

Managing CFDI compliance efficiently helps your business:

- Stay aligned with SAT tax regulations

- Avoid fines or legal risks

- Save time on manual invoicing tasks

- Scale operations without bottlenecks

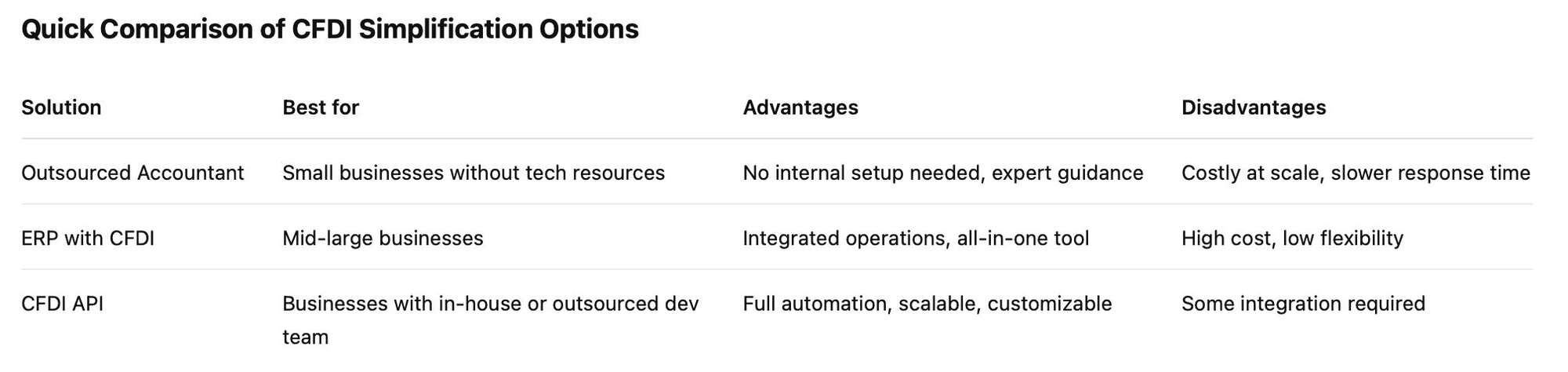

Options to Simplify CFDI Compliance

1️⃣ Outsource to an Accountant or Tax Specialist

Many small and medium-sized businesses choose to delegate CFDI management to external experts.

✅ Pros

- Minimal internal effort: Your accountant handles SAT rules and invoicing.

- No need for in-house technical infrastructure.

- Professional guidance on evolving SAT compliance requirements.

⚠️ Cons

- May delay urgent invoice issuance or cancellation.

- Limited visibility into invoicing operations.

- Loss of control.

- Costs increase as invoicing volume grows.

- Harder to scale or automate processes.

⚠️ Note: While an accountant can issue invoices on your behalf, your business remains legally responsible for the accuracy and compliance of the CFDIs submitted to the SAT.

2️⃣ Use an ERP System with CFDI Stamping

Well-known ERP platforms (such as SAP, Oracle NetSuite, Aspel, and CONTPAQi) provide CFDI generation and stamping features integrated into their software — typically by connecting to authorized PACs.

✅ Pros

- Invoicing is part of your business workflow.

- Consolidated reporting, accounting, and tax compliance tools.

- Suited for medium-to-large businesses with complex operations.

⚠️ Cons

- High setup and maintenance costs.

- Less flexibility to customize or change providers.

- SAT updates (e.g., CFDI 4.0) may require costly upgrades or consulting.

3️⃣ Integrate a CFDI API into Your Software

A CFDI API offers the most flexibility for businesses wanting to automate invoicing or embed it into their apps, e-commerce platforms, POS systems, or custom ERPs.

✅ Pros

- Seamless integration with your existing systems.

- Automate CFDI issuance, cancellation, validation, and storage.

- Scales easily as your business grows.

- Advanced options: SAT synchronization, audit tools, multi-country e-invoicing.

- Potential to “white label” invoicing services and CFDI stamping under your brand.

✅ Even if the experience is branded, all CFDIs must show your business’s RFC as the legal issuer.

⚠️ Cons

- Minimum development resources for integration.

- The API’s quality (documentation, features, reliability) matters — choose wisely.

- Cancellation workflows must respect SAT rules, including client approval when applicable.

⚠️ Important: Automating cancellations should follow SAT requirements, such as cause codes and recipient approval when mandated.

Frequently Asked Questions (FAQs)

What is CFDI compliance in Mexico?

CFDI compliance means issuing, managing, and storing digital tax receipts (electronic invoices) according to SAT’s official rules, including CFDI 4.0 standards. For more detail, see this article: Simple guide to CFDI compliance in Mexico

How can small businesses automate CFDI invoicing?

By integrating a CFDI API or using a compliant ERP, small businesses can issue invoices automatically without manual data entry. For more detail on the CFDI API approach, see this article: Simplifying Compliance with a CFDI API.

What happens if I don’t comply with CFDI requirements?

Non-compliance can lead to rejected invoices, tax audits, penalties, or business disruptions.

Can I issue invoices without full customer information?

In some specific cases, the SAT allows invoices withonly the customer name data.

Final Thoughts

Simplifying CFDI compliance helps your business operate smoothly, avoid costly mistakes, and stay ready for future SAT updates. Whether you choose to outsource, adopt ERP software, or integrate a CFDI API, the key is to match the solution to your size, resources, and growth plans.

This article is for informational purposes only and does not constitute legal or tax advice. Please consult with a certified tax advisor or accountant for guidance specific to your business.